Not known Facts About Stock Trading

Wiki Article

The 9-Second Trick For Stock Trading

Table of ContentsHow Stock Trading can Save You Time, Stress, and Money.The 6-Minute Rule for Stock TradingStock Trading for BeginnersSee This Report on Stock TradingStock Trading Things To Know Before You Buy

Customers are constantly bidding for the supplies that other capitalists are ready to sell. If there is a whole lot of demand for a stock, financiers will acquire shares quicker than vendors want to get rid of them. This can move the rate higher. On the other hand, if more financiers are selling a stock than buying, the marketplace rate will certainly go down.

That's where market makers are available in. A crucial principle when it involves understanding the stock exchange is the suggestion of a market maker. Especially, there aren't constantly customers to pair up with sellers of supplies. Nonetheless, stock trades typically go via in seconds. Just how can brokers deal stocks in your account immediately? People called market makers act as intermediaries between purchasers and sellers.

Get This Report about Stock Trading

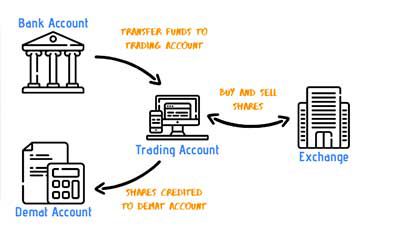

With a fluid market similar to this, capitalists can choose to deal shares quickly whenever they want throughout market hours. Right here's a rundown of what investors need to learn about the process: Market manufacturers purchase and hold shares as well as constantly list buy-and-sell quotations for shares. The highest possible offer to acquire shares provided from a market manufacturer at any kind of provided time is called the proposal, and the lowest provided offering rate is referred to as the ask.A broker might be an actual person whom you tell what to buy and also offer. When you acquire a stock, here's the simplified variation of just how it works: You tell your broker (or input electronically) what stock you desire to purchase and how numerous shares you desire.

8 Easy Facts About Stock Trading Explained

These are used as a benchmark to compare the performance of individual stocks or a whole portfolio. The S&P 500 index tracks the efficiency of 500 of the largest publicly traded business in the U.S.Indexes are a practical means to talk about an approximation of what is occurring in the market.There are 3 different terms below with similar and frequently misunderstood definitions: Stock market: The procedure and also assistance of investors getting as well as selling stocks with one an additional. Stock index: A mathematical representation of a group of supplies that is utilized to track their cumulative efficiency.

You'll comprehend why your investments can be acquired and marketed at a moment's notification.

Some Known Details About Stock Trading

The Motley Fool recommends the complying with choices: lengthy March 2023 $120 contact Apple and also short March 2023 $130 telephone calls on Apple. The has a disclosure plan.Capitalists deal stocks for a variety of reasons consisting of the potential to expand the value of their investment with time, to possibly benefit from shorter-term stock cost steps, or even to earn an income by purchasing dividend-paying stocks. Keep in mind that the rate of a supply can fall as easily as it can increase.

Individuals trade supplies for one factor: to earn money. In order to profit, they require supplies to vary and the even more they move, the better. Stocks are one of one of the most volatile possessions in the general public markets much extra than the somber possession course of bonds so they supply a use this link lot of potential to relocate.

7 Simple Techniques For Stock Trading

Supplies aren't as volatile as alternatives, however, as well as that's one factor that find options have actually come to be a very prominent security to trade. Nonetheless, supplies are more flexible. That is, unlike options that can shed all their worth over a short time, supplies tend to retain much of their value.

On the various other hand, financiers who purchase as well as hold an extensively varied basket of supplies (such as the Standard & Poor's 500 index) may delight in the lasting admiration of the stock exchange with very little work annually. So you've determined you intend to trade stocks what sort of approaches are you going to utilize? Are you mosting likely to be a scalper, trying to obtain a couple of cents on every trade? Are you mosting likely to just get stocks or are you also mosting likely to short-sell them? At what factor will you reduce losses as well as recognize gains? Are you mosting likely to do turn trading, attempting to ride a much longer up or down relocate a supply? Or will you be a day trader, trading in and out of a placement review in a day or 2? Those are just a few of the lots of concerns you may intend to ask on your own as you start trading.

Report this wiki page